About us

About Thallium Consulting

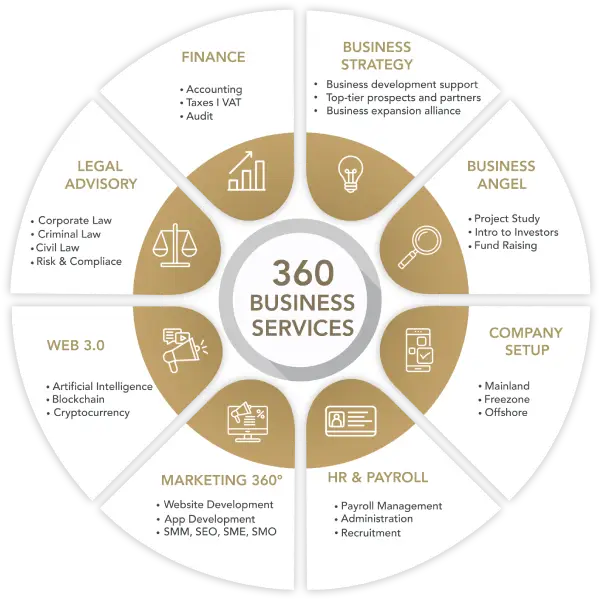

Thallium Consulting is a strategy and business development firm — A pioneer of 360º business solutions across the world, especially in Dubai, the UAE (Middle East) and Europe. In the current business state, companies must endeavour to be dynamic and flexible in order to take advantage of valuable opportunities. Therefore, we provide a complete package of first-class tailored services helping entrepreneurs and companies in expanding and establishing their businesses seamlessly across international borders.

what we offer

Discover the variety of services that we offer

We provide end-to-end assistance in creating your company, from document administration to legal status advising and bank account opening.

Count on us every step of the way.

Company Setup

We assist you in the creation of your company from documents administration, company’s...

Business Strategy

Experience business growth with us. From market studies, business strategies and setting up your...

Marketing 360º

We offer website & mobile app development, marketing automation, and implementation of SEO, SEM...

About us

360º Business Solutions

Are you a Start-Up, SME or Individual and have a Business Idea?

Do you want to implement a new strategy to develop your business, increase your activity, and have better profitability?

Do you want to attract more customers, partners, and investors?

Thallium Consulting is the expert in business strategy you are looking for. Our consultants will guide you in the implementation and development of your business project.

You have a business proposal and are looking for a Business Angel ?

Thallium Consulting helps entrepreneurs raise funds and supports them in their growth. We assist entrepreneurs to connect with potential investors around the world. Thanks to our extensive network of investors, we aid you to ascertain the right business angel. Our network has investors in various segments of the market so that the partnership that is formed can bring not only investment and capital financing to the table but also gain experience in the overall market segment.

Looking for a company set-up and confused about where to start?

Whether you are a startup, small business or individual, you will need a business license to start a business in the UAE or around the world.

Thallium Consulting encourages all types of companies (start-ups, SMEs, etc.) to set up businesses around the world. We provide an end-to-end business solution to our clients, whether it is a new or existing company, we help you through all the levels of your business formation plan from the choice of legal status, obtaining a business license, visa, to a bank introduction.

How to create a global digital presence and maintain the upper hand?

Thallium Consulting is a full-service marketing company, providing a spectrum of 360 marketing services to clients in the UAE, France, and worldwide. We assist companies in building their digital presence globally by developing websites, mobile applications, and social networks. We help companies target their audience by using highly competitive keywords and strategies to maximize their return on investment. We make sure businesses get their presence on search engines organically for lasting results.

Why is community management essential for businesses?

With the incredible growth of multiple platforms, social media has emerged as a fast and efficient way to connect with your customers and address their concerns in real-time. The increase in the number of subscribers, users, and followers in your community is a sign of flourishing notoriety. Knowing how to organize your content along with your social networks is the foundation of success for companies and businesses. Many businesses are taking advantage of this low-cost opportunity to increase their community and target audience. Thallium experts are here to help you grow and manage your community more efficiently and effectively.

Do you wish to outsource your accounting or carry out an Audit?

Thallium Consulting will guide you through all financial issues regarding your business. The financial services offered by us in the United Arab Emirates and France provides access to a variety of key financial marketplaces. It offers practical advice and recommendations to better understand the key issues that are encountered by international and local businesses and we offer you tailor-made accounting services.

Do you want to outsource a team, consultant, or payroll system?

Thallium Consulting offers timely, secure, reliable, and accurate payroll outsourcing in over 100 countries around the world. We provide all the necessary support for the management of consultants and employees.

Recruiting ? Trust Thallium Consulting to find the right fit

Are you looking for new talents to expand or strengthen your team?

Advertising for the right applicants in the right places can be a daunting and time-consuming task. Thallium Consulting uses its extensive network, expertise, knowledge, and experience to obtain the right candidate.

Are you looking for advice or want to defend your rights?

Legal services are a critical factor for any business owner, but particularly for small business owners, who often face many legal hurdles. Business litigation ensures the protection of the owner’s assets, protection of the business from discrimination, allegations, sexual harassment, wrongful termination, handling employees’ contracts, copyright claims, and incorporation are merely a few of the legal issues that small business owners typically face. Our advisors and legal experts are there to advise or represent you wherever you are.

Work Process

Our experts are with you every step of your project

Evaluate

At first, our team assesses the needs of the company and its fundamentals

Plan

Our experts provide you with the best solutions suitable to your project.

Develop

We develop different solutions and put them in place.

Deploy

We validate everything and start the project.

Contact us for any query you may have

Phone

France+33 1 76 36 09 11

UAE+971 4 552 1636

info@thallium-consulting.com